New 1099 Rules 2024 Explained – It’s officially tax season. Use this guide to find all the answers you need for getting your taxes filed this year. . Fortunately, there are plenty of tax-advantaged options available for 1099 workers by Congress has numerous new provisions that are coming to bear in 2024, including new penalty-free .

New 1099 Rules 2024 Explained

Source : markjkohler.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.eduIRS delays 1099 K rules for side hustles, ticket resales

Source : www.usatoday.comFacilities Face New DOL Worker Classification Rule | IntelyCare

Source : www.intelycare.com1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.comIRS delays 1099 K rules for side hustles, ticket resales

Source : www.usatoday.com1099 Rules for Business Owners in 2024 Mark J. Kohler

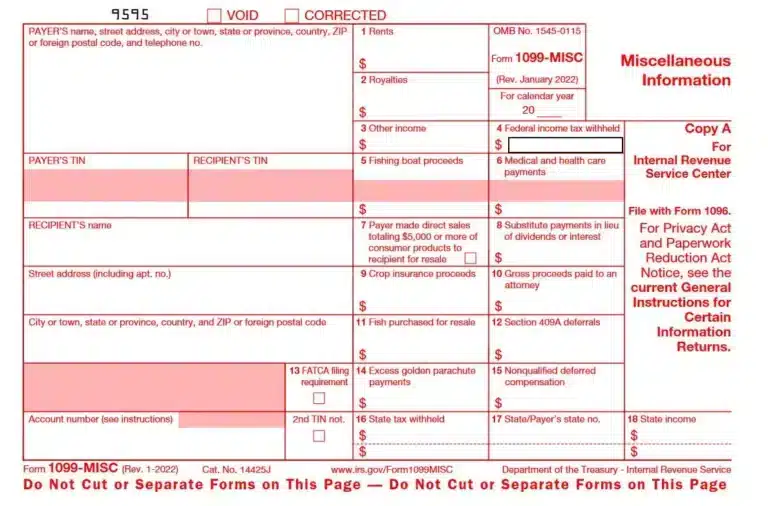

Source : markjkohler.comForm 1099 MISC Explained: Instructions and Uses

Source : tipalti.comLetter Carriers on X: “This month’s Postal Record includes an

Source : twitter.comJudy Greenfeld Vice President All Stiles Inc | LinkedIn

Source : www.linkedin.comNew 1099 Rules 2024 Explained 1099 Rules for Business Owners in 2024 Mark J. Kohler: Patty Ellison says her 1099-MISC from the UAW indicates that she needs to report $2,600 in strike benefits when she files her 2023 income tax returns this year. It’s a decent chunk of change that . More than 95% of the new benefits for 2023 would go to households These families get a smaller credit under existing rules, in part because many don’t earn enough money or owe taxes. .

]]>